Maintaining 500,000+ Global FinCrime & AML Contacts

Gungho has been mastering the art of lead generation and appointment setting for RegTech, FinCrime, Fraud & Risk Technology Vendors since 2007. Over this time, their team of 140+ lead generation experts have built and maintained a unique and ever-evolving dataset which houses 500,000+ decision-makers in the field of Legal, Risk and Compliance.

Gungho leverage this data set for appointment setting, email marketing and increasing brand awareness.

Although Gungho boast 500,000+ contacts, they pride ourselves on the relevance of their data. They reduce irrelevant job titles that create noise and slow workflow. The successes of Gungho’s campaigns are based on two key ingredients which rely on their strong data set:

One: Being able to accurately identify the target audience

Two: AML & FinCrime accredited team of English & multi-lingual Gungho callers

Maintaining a data set of 500,000+ Compliance & Risk Contacts

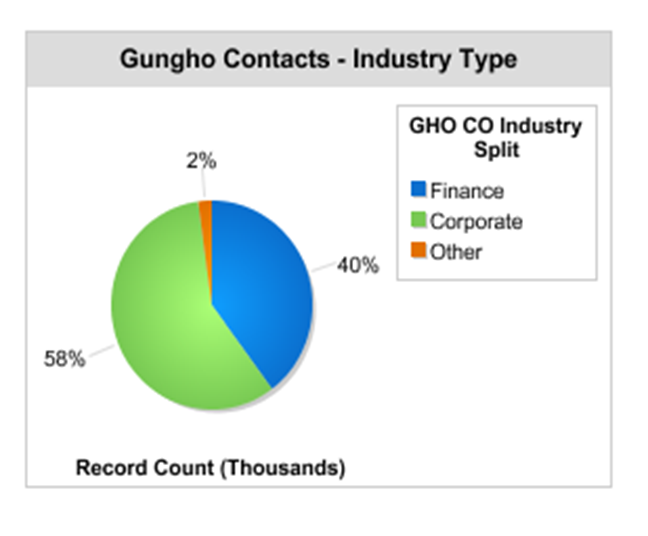

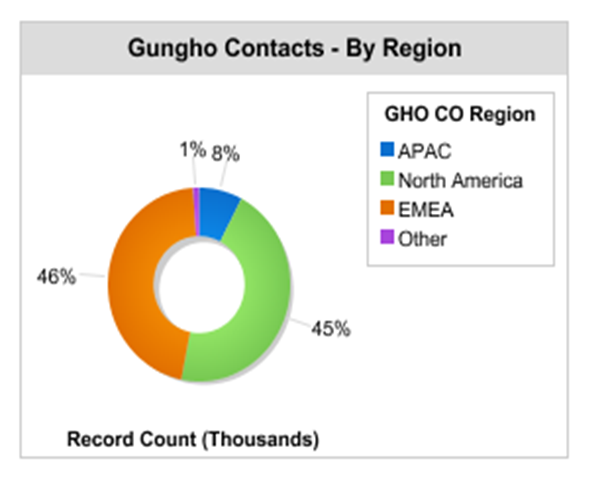

Today, Gungho boasts an impressive 500,000 FinCrime and AML contacts and 110,000 accounts – a number that grows daily due to a diligent team of researchers and callers. Accessing this data set enables each of their clients campaigns to short-cut time to market and quickly ramp-up revenues.

Gungho provide reliable and expansive coverage of most Compliance & Risk job titles; Money Laundering Reporting (MLRO), CF11, CF10, Banking Secrecy Act (BSA), Risk, Compliance, AML, KYC, Due Diligence, Supply Chain Risk, 3rd Party Risk, Legal Counsel, Fraud, Financial Crime, Sanctions, OFAC, On-Boarding, Monitoring & Audit.

Gungho profile financial and corporate organisations. Inside multi-national & corporate accounts, the Gungho data set typically covers Legal Counsel, 3rd Party Risk, Supply Chain Risk, Vendor Management, GDPR, Security, Asset Protection, Trade & Export Compliance, Audit and Anti-Bribery & Anti-Corruption.

In the regulated Financial Sector, the Gungho data set covers a broad range of job titles ranging from Anti-Money Laundering, Compliance, Governance, Risk, Financial Crime Detection, Fraud Detection, KYC, On-Boarding, Enhanced Due Diligence, Screening, Sanctions + PEPS, OFAC to Banking Secrecy Act Officers (BSA).

Gungho’s expansive data set is at the core to their successful client campaigns; enabling their AML & FinCrime accredited Business Discovery Agents to make 1000’s of calls each day and increasing their conversion rates exponentially. An impressive 43% of Gungho appointments become opportunities for their clients.

Want to find out more about this data set and how Gungho can help you? Get in touch now!