What is RegTech?

RegTech, short for ‘Regulatory Technology’, is the application of emerging technology to improve the way businesses manage regulation and compliance.

But what do the terms ‘regulation’ and ‘compliance’ even mean? Well, the term ‘compliance’ in a business environment simply means conforming to laws, regulations, rules, and policies as part of business operations. So, compliance is basically making sure that organisations adhere to all statutory, regulatory, and legal requirements.

For example, financial institutions have a legal obligation to know who they are doing business with and where their customer’s money is coming from. The last thing they want to do is facilitate money laundering or the proceeds of human trafficking or drug cartels. To ensure that doesn’t happen, organisations put strict compliance procedures in place and use specialised software (RegTech) which completes complex checks against things like government sanctions lists. The technology which makes these checks fast, secure, and accurate brings productivity, efficiency, lowering of costs, increased safety, and confidence to regulated entities.

RegTech companies are usually founded by technology entrepreneurs or ex-industry practitioners. RegTech software is not just for financial institutions but is widely adopted by corporates, who wish to reduce their exposure to risk, be it 3rd party risk, money laundering, financial crime, sanctions, or political exposure.

How Does RegTech Help Regulated Entities?

The Consequences of Regulatory Failure

Managing risk is no joke. In 2020, regulatory fines for financial institutions amounted to a whopping $10.4 billion! A recent report, published by FSTech revealed that 198 fines were issued to global financial institutions in 2020, for non-compliance with Anti-Money Laundering (AML), Know your Customer (KYC), data privacy and MiFID (Markets in Financial Instruments Directive) regulations.

Organisations need to avoid these fines at all costs and as a result, spending on compliance in Financial Services will exceed $127 billion by 2024 up from $25 billion in 2019. That’s quite a leap!

Countries that issued the most fines by value:

- USA $ 4,348,701,664

- Malaysia $ 3,900,000,000

- Australia $ 921,587,910

- Sweden $ 550,169,770

- UK $ 199,306,927

Of course, RegTech isn’t just adopted to avoid regulatory fines, it provides tools to manage, monitor and oversee all facets of risk, it gives greater transparency for boards and management teams and improves efficiency and productivity. Most importantly, it means that the baddies of the world, who are involved in organised crime such as arms trading, modern slavery, and cybercrime, are stopped in their tracks and unable to wash their dirty money.

Related Terminology

RegTech enables regulated businesses to accelerate their compliance and risk processes, solving regulatory and compliance requirements more effectively and efficiently. A common mistake is to put FinTech (Financial Technology) and RegTech in the same bucket – but the two should not be confused. FinTech relates to any business that uses technology to enhance or automate financial services and processes. You may sometimes hear the term SupTech used alongside RegTech – the two are intertwined, with the term SupTech (Supervisory technology) often used to describe reporting and regulatory processes, resulting in more efficient and proactive monitoring of risk and compliance at financial institutions.

The RegTech Eco-System

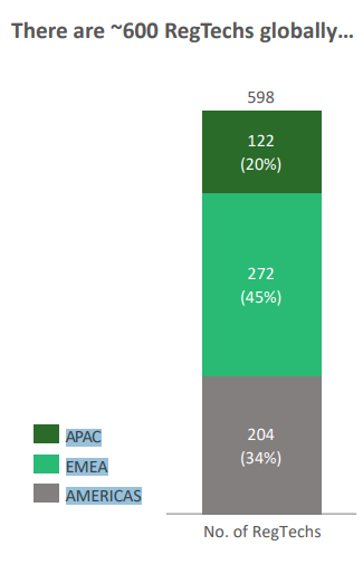

Gungho estimates that there are over 1000 RegTech companies worldwide. In a recent presentation by the Australian RegTech Association, they estimated, slightly less at just under 600:

Want to be a part of the RegTech Industry?

Joining a company in the RegTech ecosystem is a great place to grow your career! In a recent report, published by the City of London, and RegTech Associates – most RegTechs are optimistic about their commercial performance, with almost two-thirds experiencing sales growth in 2020 and an even larger majority, (82.3%), expecting further growth in 2021. Not bad given the landscape of a global pandemic….