Since 2007, Gungho has been at the forefront of lead generation and appointment setting for global RegTech, FinCrime, Fraud & Risk Technology Vendors. Over these years, our dedicated team of Discovery Agents & Data Researchers has meticulously curated and continuously expanded a one-of-a-kind dataset encompassing professionals responsible for navigating and mitigating the intricate landscape of money laundering, financial crime, fraud, sanctions, bribery, supply chain due diligence, corruption, and third-party risk.

What sets our dataset apart is not just its depth, but its dynamism. Our dataset is in a constant state of evolution and grows by over 10,000+ new contacts each month – each of these entries is meticulously researched and carefully curated, one by one.

Additionally, we keep our dataset fresh by continuously updating over 30,000 existing contacts every month. These updates capture a range of changes, from contacts switching up roles within the same organisation to changing locations, adopting new email addresses, or transitioning to different companies.

Our dataset is always in tune with the latest moves in the industry.

Data-Powered Growth

Leveraging our robust dataset drives tangible results. Precise targeting enhances conversions, while strategic outreach boosts brand awareness. With accurate data, RegTechs can navigate competitive landscapes, fuel data-driven insights and accelerate business growth with meaningful engagement.

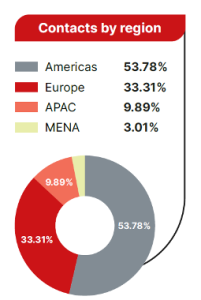

Our comprehensive dataset, now exceeding 500,000+ contacts within 110,000+ accounts, forms the bedrock of our lead generation and appointment setting service, and email marketing service. By leveraging this robust dataset, our clients are equipped to streamline their route to market, precisely target contacts and accounts, enhance brand visibility, and significantly expedite revenue generation.

Our data set is split between senior decision-makers inside both financial and corporate organisations.

Inside Non-Financial Corporate accounts we profile job titles such as Legal Counsel, 3rd Party Risk, Supply Chain Risk, Vendor Management, GDPR, Security, Asset Protection, Trade & Export Compliance, Regulatory Control, Audit, Anti-Bribery & Anti-Corruption.

Whereas, in the regulated Financial Sector, the Gungho data set covers a broad range of job titles ranging from Anti-Money Laundering, Compliance, Governance, Risk, Financial Crime Detection, Fraud Detection, KYC, On-Boarding, Enhanced Due Diligence, Screening, Sanctions + PEPS, OFAC to Banking Secrecy Act Officers (BSA).

See chart below of some of our Job Title coverage;

Our data set is split between senior decision-makers inside both financial and corporate organisations.